What Takes Place When Vehicle Crash Case Exceeds Insurance Policy Limits?

Instead, you're usually making an insurance claim against your very own insurance company. Insurer' purpose is to pay you as low as possible; they may even deny your case and pay you nothing. Additional making complex the issue, greater than someone or entity might be responsible Fender bender for your injuries. Allow's say that the value of your vehicle crash situation is $40,000, yet the negligent vehicle driver only has $25,000 in obligation protection.

Underinsured motorist coverage spends for clinical costs and various other expenditures when Immigration lawyer you're struck by someone who does not have adequate insurance. About one in seven vehicle drivers is uninsured, according to the Insurance coverage Study Council. That makes it crucial to understand uninsured driver coverage, as it can pay you and your passengers' clinical costs, shed incomes, and a lot more if an uninsured driver accidents right into you. There are several types of insurance policy coverage that vehicle drivers can purchase to secure themselves and others. Responsibility insurance coverage is needed by law and covers problems to 3rd parties.

How Do I Make A Without Insurance Motorist Insurance Claim?

This could result in high legal charges and court judgments that you'll need to pay. You may deal with certificate suspension or cancellation, car impounding, penalties, and also jail time. Plus, not having insurance coverage can make your rates go up when you do obtain insured once again.

Taking Legal Action If Required

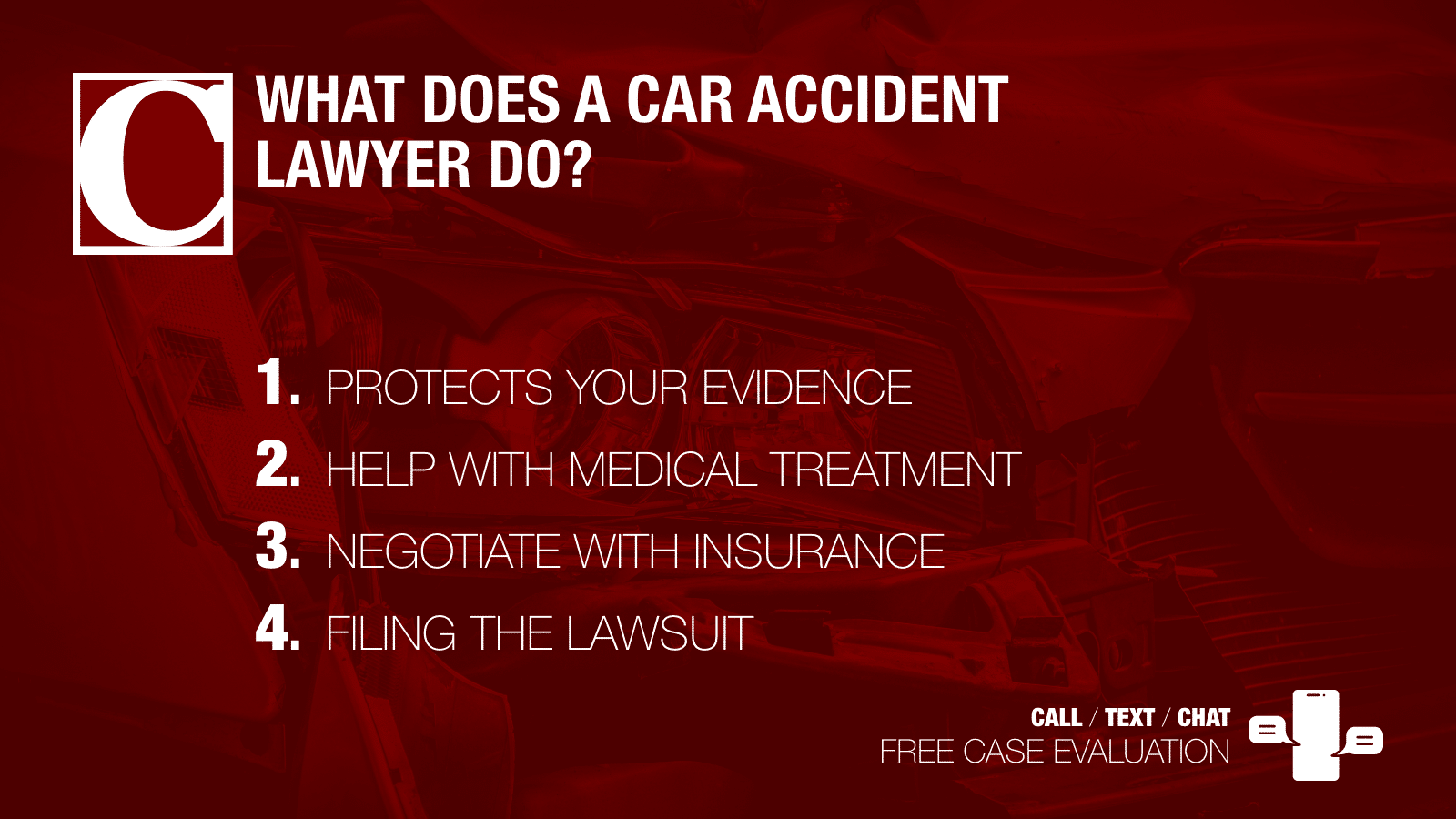

- Consulting a cars and truck accident attorney from the Legislation Offices of Robert E. Brown, P.C.It's generally sensible for automobile crash sufferers to get regional legal help.Many insurance provider limit the amount of time policyholders need to make without insurance motorist and underinsured vehicle driver claims (usually it's as few as one month from the date of the accident).Maria Filindras is a monetary consultant, a licensed Life & Health insurance agent in The golden state, and a participant of the Financial Evaluation Council at Policygenius.An underinsured driver insurance claim will normally take a bit longer to establish, at least up until your clinical treatment advances and you obtain an understanding of the value of your automobile accident situation.

That's a 17% rate boost contrasted to a motorist with a tidy document. The most affordable states for getting minimal insurance coverage at age 30 are Wyoming, Vermont and Iowa. Vermont, Maine, Idaho and Hawaii are the least expensive states for 30-year-olds getting a full insurance coverage plan, while Florida and Louisiana set you back one of the most.

Do Insurance Provider Pursue Without Insurance Drivers?

Yet, there are choices to assist if you're struck by somebody without insurance coverage. Without insurance motorist coverage and the Colorado Criminal Offense Victim Payment Program can provide financial backing. Allow's say, for instance, the at-fault vehicle driver has a $100,000 policy restriction contracted with their insurer, however your damages total $170,000. That extra $70,000 would certainly fall under the "excess verdict" the court awarded.